Fintech-as-a-service market size is expected to expand at a growth rate of 18.2% from 2022 to 2030.

- Retail Banks plan to develop inventive new applications for Embedded finance, ESG and digital assets. The new ways to serve and engage with customers. This demands banks to go beyond and create personalized customer experiences using data across channels

- Commercial Banks are demanding data-rich solutions and new service models with insights and digital tools to win corporate client wallets

- Digital consumer payments are expected to accelerate and transform the payments experience on multiple fronts. Banks are unwavering and unlock deeper financial relationships beyond transaction flows and payment as a service.

- Wealth Management organizations are optimizing and reshaping business models, Infrastructure and product strategies

- In spite of recent market uncertainties, Transactional banks are achieving their Digital Aspirations by migrating to new ISO standards and are focusing on building scalable, modern and efficiency technology platforms to provide a 360-degree real-time view of client transactions, actionable insights and innovation to better serve their clients

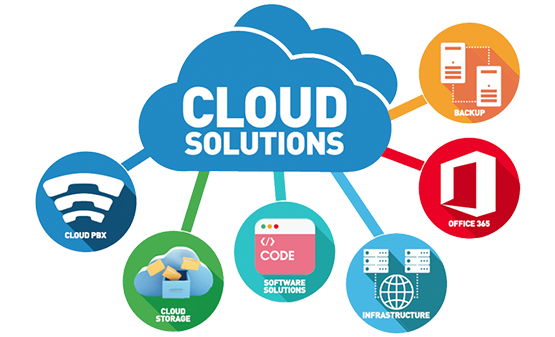

Our services systematically smooth the path to fintech innovation and meet the evolving infrastructure changes.

- Highly scalable cloud-based solution that enables mass scale in a matter of hours

- High-performance global network of numerous access points that allow high-speed networking with very low latency to support video conferencing

- Generate daily or weekly risk and security reports, gaining or maintaining insights into employee productivity

- Integration with existing corporate Infrastructure, providing access to on-premise environments

- Managed SOC environment to quickly support enterprise security teams

- Solve longer-term VPN and disaster recovery requirements